What is Blue Cross Health Insurance and why is it the most affordable coverage for your well-being? Blue Cross Health Insurance: Affordable Coverage For Your Well-Being

Editor's Notes: Blue Cross Health Insurance: Affordable Coverage For Your Well-Being has published today date. Knowing about Blue Cross Health Insurance: Affordable Coverage For Your Well-Being is important to the preservation of your health.

With so many different health insurance plans on the market, it can be hard to know which one is right for you. But if you're looking for affordable coverage that will protect your health, Blue Cross Health Insurance is a great option.

Here are just a few of the benefits of Blue Cross Health Insurance:

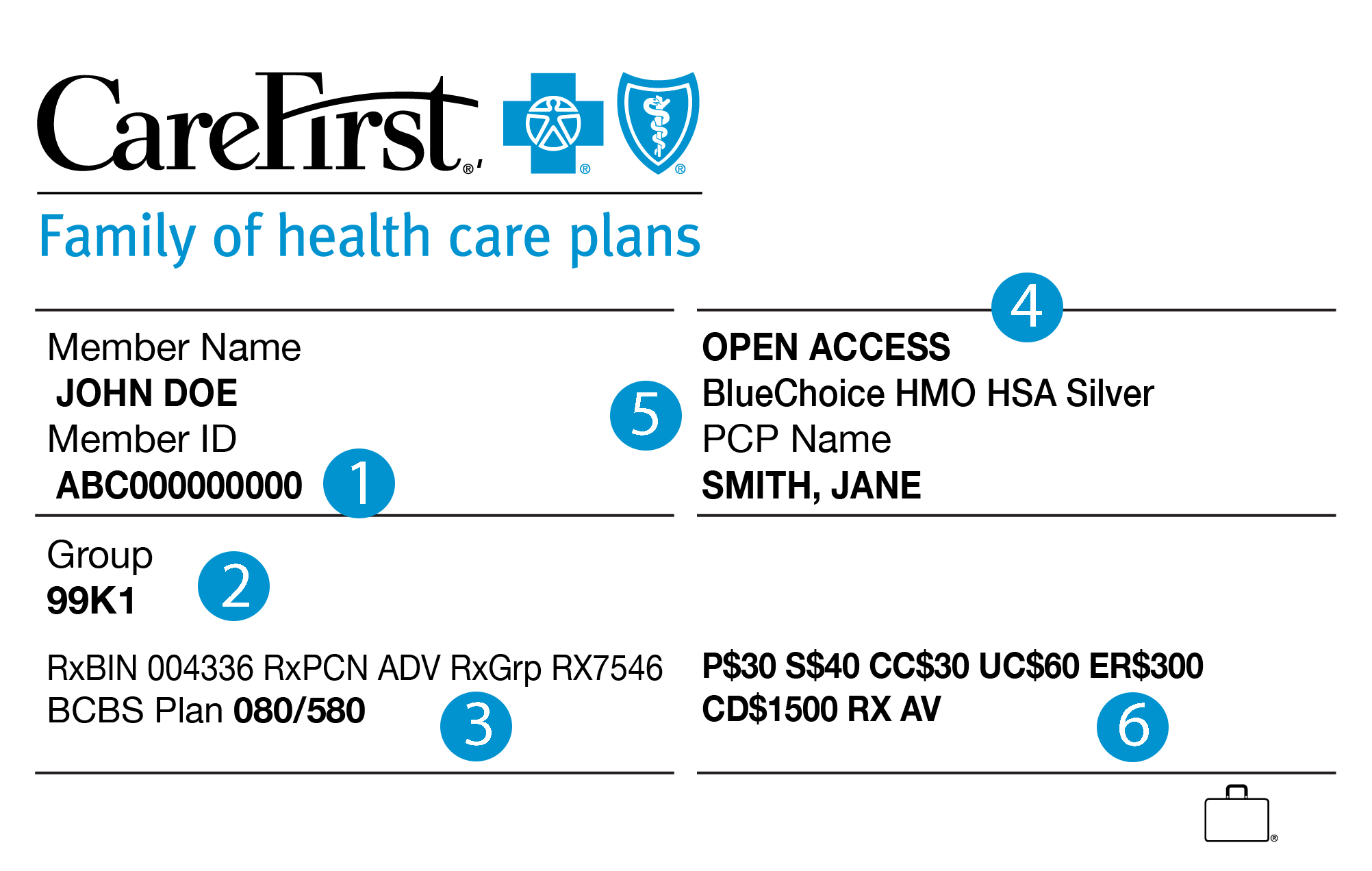

Quick and Easy Ways to Pay Your Carefirst Bill - Source activitycovered.com

- Affordable premiums

- Low deductibles

- Wide network of doctors and hospitals

- Comprehensive coverage for a variety of health care services

If you're looking for affordable health insurance that will protect your health, Blue Cross Health Insurance is a great option. With a variety of plans to choose from, you're sure to find one that fits your needs and budget.

FAQ

Blue Cross Health Insurance is committed to providing affordable and comprehensive coverage for your health and well-being. Here are answers to some of the most frequently asked questions we receive:

Elements Medavie Blue Cross Health Insurance | Cluett - Source cluettinsurance.ca

Question 1: What are the benefits of having health insurance through Blue Cross?

Blue Cross offers several advantages, including:

Question 2: How much does health insurance through Blue Cross cost?

The cost of health insurance through Blue Cross varies depending on your age, location, and the plan you choose. However, we offer affordable options to fit most budgets.

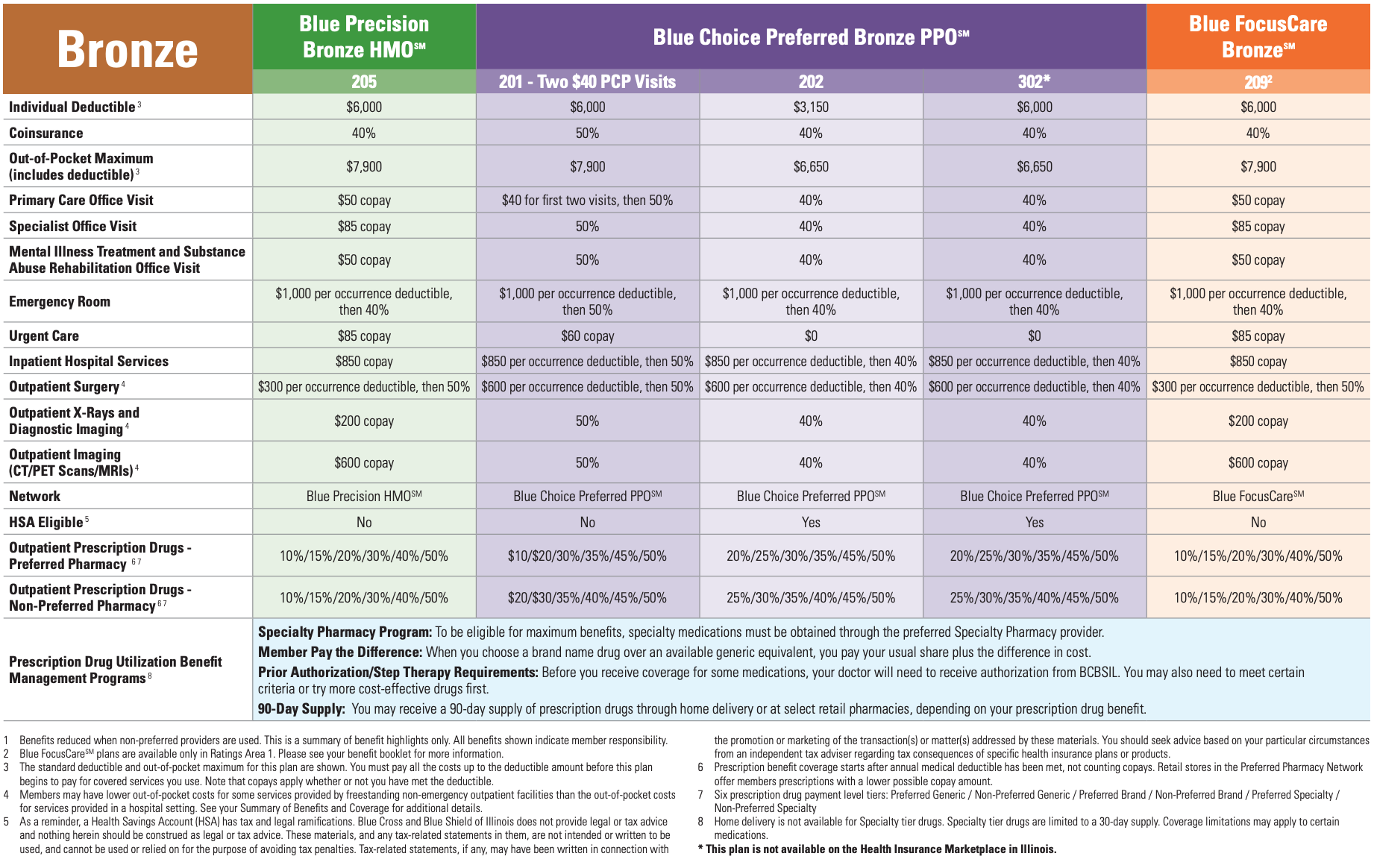

Question 3: What is the deductible for a Blue Cross health insurance plan?

The deductible is the amount you pay out-of-pocket for covered healthcare services before your insurance starts to cover the costs. The deductible amount varies depending on the plan you choose.

Question 4: What is coinsurance?

Coinsurance is the percentage of the cost of a covered healthcare service that you are responsible for paying after you have met your deductible. For example, if your coinsurance is 20%, you will pay 20% of the cost of the service and your insurance will pay the remaining 80%.

Question 5: What is the difference between a PPO and an HMO?

A PPO (Preferred Provider Organization) gives you the flexibility to see any doctor within the network, without a referral. An HMO (Health Maintenance Organization) requires you to choose a primary care physician who will refer you to specialists as needed.

Question 6: How do I file a claim with Blue Cross?

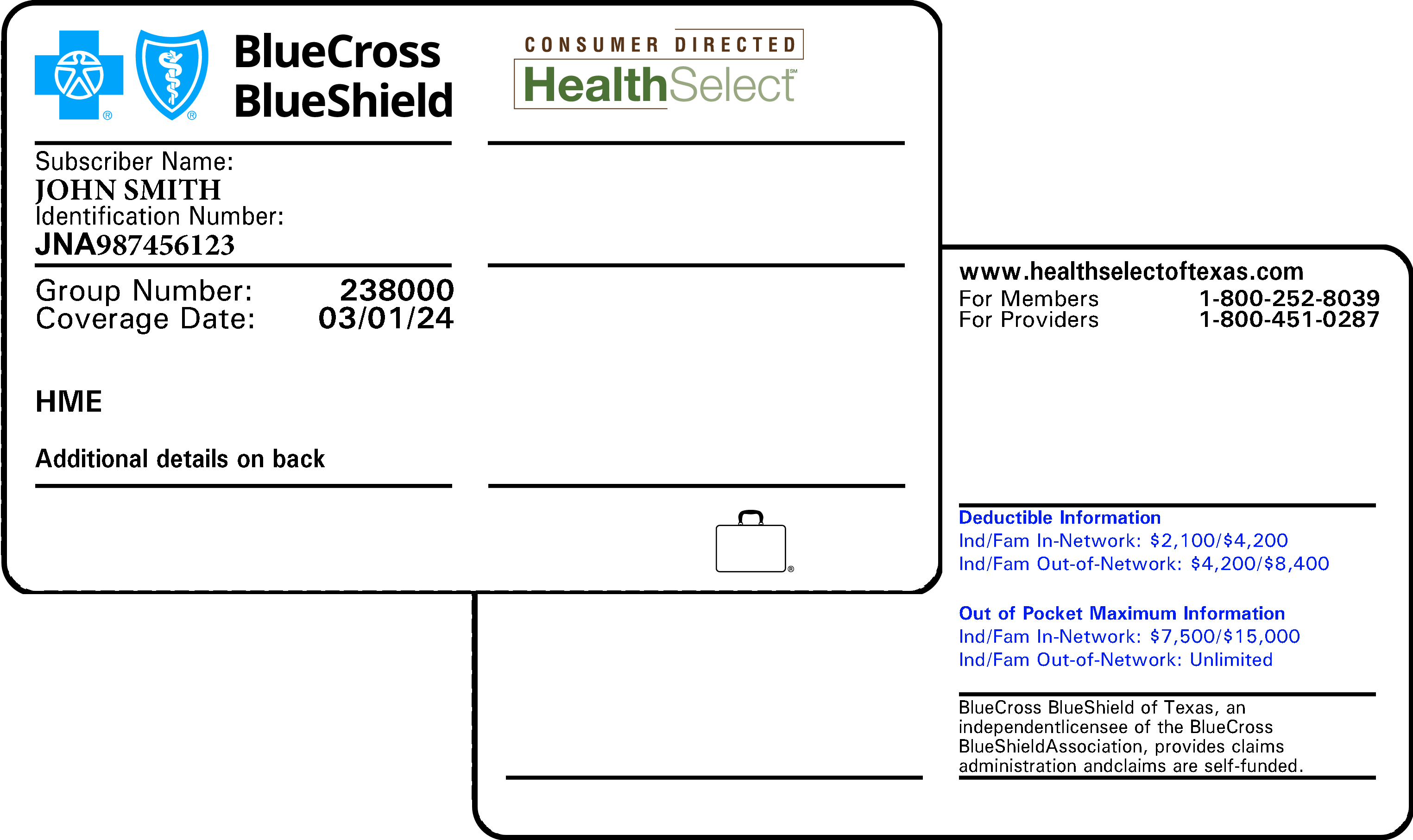

You can file a claim with Blue Cross online, by mail, or by fax. You will need to provide your member ID number, the date of service, the type of service received, and the amount of the charge.

We are here to help you find the right health insurance plan for your needs and budget. Contact us today to learn more.

To learn more about health insurance, check out our other articles:

- The Importance of Health Insurance

- How to Choose the Right Health Insurance Plan

- Understanding Health Insurance Terminology

Searching for affordable health insurance that provides comprehensive coverage for your well-being? Look no further than "Blue Cross Health Insurance: Affordable Coverage For Your Well-Being."Blue Cross Health Insurance: Affordable Coverage For Your Well-Being is a health insurance company that offers a wide range of plans to meet the needs of individuals and families.

Anthem Blue Cross Gets Flagged And Fined More Than Other Insurers - Source www.pinterest.co.uk

Editor’s Note: Blue Cross Health Insurance: Affordable Coverage For Your Well-Being published on [today’s date ]. The today’s market is super competitive, it’s very important to have the best coverage possible to protect you and your family from unexpected medical expenses. Health insurance protects you from potential risks and financial burdens in case of medical emergencies.

After analyzing many health insurance companies and digging into the details of their plans, we have put together this easy-to-understand guide to help you make the right decision about your health insurance.

Key Differences:

| Feature | Blue Cross Health Insurance | Other Health Insurance Companies |

|---|---|---|

| Monthly Premiums | Affordable | Vary depending on the provider |

| Coverage | Comprehensive | May be limited or exclude certain services |

| Network of Providers | Extensive | May be limited to certain areas or providers |

| Customer Service | Highly rated | May vary depending on the provider |

Transition to Main Article Topics:

FAQ

This FAQ section addresses common questions and concerns regarding Blue Cross Health Insurance's coverage options and services, providing informative and comprehensive explanations to assist you in making informed decisions about your health insurance needs.

Question 1: What is the range of coverage options available with Blue Cross Health Insurance?

Blue Cross Health Insurance offers a spectrum of coverage plans tailored to meet diverse needs and budgets. These plans include comprehensive coverage for preventive care, hospitalization, prescription drugs, and specialist visits, ensuring access to essential healthcare services.

Blue Cross Blue Shield Rates For 2024 - Audra Candide - Source ivoryqjennie.pages.dev

Question 2: How does Blue Cross Health Insurance prioritize affordability?

We understand that healthcare costs can be a concern, which is why we strive to provide affordable coverage options. We offer a range of plans with varying premiums and deductibles to cater to different financial situations and ensure access to quality healthcare.

Question 3: Can I customize my coverage plan with Blue Cross Health Insurance?

Yes, we offer flexibility in customizing your coverage. Through our modular approach, you can tailor your plan by adding or removing specific benefits and riders. This allows you to create a plan that aligns precisely with your healthcare needs and preferences.

Question 4: What is the process for filing a claim with Blue Cross Health Insurance?

Filing a claim is a straightforward process. You can submit your claims online through our secure member portal, by mail, or over the phone. Our dedicated claims team will promptly review your submission and provide you with updates on the status of your claim.

Question 5: How can I access my policy details and medical records with Blue Cross Health Insurance?

We provide convenient access to your policy information and medical records through our secure member portal. You can view your coverage details, download statements, and access your medical history at your fingertips, empowering you to stay informed about your healthcare.

Question 6: What sets Blue Cross Health Insurance apart in the industry?

Our commitment to providing exceptional healthcare coverage distinguishes us. With a long-standing reputation for reliability, financial stability, and customer-centric service, we strive to deliver comprehensive health insurance solutions that empower our members to lead healthier and more fulfilling lives.

We encourage you to explore our website and contact our representatives for personalized guidance. Blue Cross Health Insurance is committed to providing you with the support and coverage you need to secure your well-being.

Transition to the next article section: For further insights into the benefits and advantages of choosing Blue Cross Health Insurance, read our comprehensive article on "Why Choose Blue Cross Health Insurance: Ensuring Your Health, One Step at a Time."

Tips

Explore these essential tips to ensure affordable and comprehensive Blue Cross Health Insurance: Affordable Coverage For Your Well-Being for your well-being:

Tip 1: Consider your Health Needs

Identify your specific health requirements, including regular check-ups, prescription medications, and potential future treatments. This assessment will help you choose a plan that aligns with your individual needs and budget.

Tip 2: Compare Plans and Costs

Thoroughly examine different health insurance plans available in your area. Compare monthly premiums, deductibles, copayments, and coinsurance rates to determine the most cost-effective option.

Tip 3: Utilize Employer-Sponsored Plans

If your employer offers health insurance, consider taking advantage of it. Employer-sponsored plans often provide competitive rates and may offer additional benefits.

Tip 4: Explore Government Programs

Investigate government programs such as Medicaid and Medicare, which provide health insurance to low-income individuals and seniors, respectively. These programs can offer affordable coverage.

Tip 5: Negotiate Lower Premiums

Reach out to your insurance provider and inquire about potential discounts or premium reductions. You may be eligible for lower premiums based on factors such as non-smoking status or healthy lifestyle choices.

Tip 6: Take Advantage of Preventive Care

Regular preventive care can help prevent costly health issues in the future. Many health insurance plans cover preventive care services, such as annual check-ups and screenings, at no additional cost.

Tip 7: Stay Informed about Changes

Insurance coverage and regulations change frequently. Stay informed about these changes to ensure your plan remains affordable and meets your needs.

Summary:

By following these tips, you can make informed decisions and secure affordable Blue Cross Health Insurance: Affordable Coverage For Your Well-Being to protect your health and financial well-being.

Blue Cross Health Insurance: Affordable Coverage For Your Well-Being

Blue Cross Health Insurance prioritizes the well-being of its members by providing comprehensive and accessible health coverage. Here are its six key strengths:

- Comprehensive Coverage: Blue Cross's plans cover a wide range of essential and preventive healthcare services.

- Provider Network: Their extensive network of doctors, hospitals, and clinics ensures easy access to quality healthcare.

- Affordable Premiums: Blue Cross's commitment to affordability makes health insurance more accessible to individuals and families.

- Well-Being Programs: They offer programs that support healthy lifestyles and proactive health management.

- Customer Service: Blue Cross is dedicated to providing exceptional customer support, ensuring members receive the assistance they need.

- Community Involvement: They are actively involved in local communities, promoting health and wellness initiatives.

Health Insurance Card Front And Back - Source ar.inspiredpencil.com

Blue Cross's focus on comprehensive coverage, provider network, and affordability is exemplified by their recent expansion of telehealth services, providing convenient and accessible care during the pandemic. Their well-being programs, such as fitness challenges and nutritional guidance, empower members to take an active role in their health. Blue Cross's commitment to customer service is reflected in their consistently high customer satisfaction ratings. Moreover, their community involvement initiatives demonstrate their dedication to improving the overall health and well-being of the communities they serve.

Blue Cross Health Insurance: Affordable Coverage For Your Well-Being

Blue Cross Health Insurance offers affordable coverage for your well-being, ensuring you have the peace of mind knowing that you are protected against unexpected medical expenses. With a comprehensive range of plans to choose from, Blue Cross makes it easy to find the coverage that is right for you and your budget. Their plans cover a wide variety of health care services, including preventive care, doctor visits, hospital stays, and prescription drugs.

Blue Shield Summary Of Benefits 2024 - Jami Rickie - Source jenaqshelba.pages.dev

Investing in health insurance is crucial for ensuring your well-being and financial security. Blue Cross Health Insurance provides affordable coverage options that cater to your specific needs. Their plans are designed to help you manage the costs of healthcare, allowing you to focus on your health and well-being without worrying about excessive financial burdens

Remember, having health insurance is not just about covering medical expenses. It's about protecting your financial future and ensuring you have access to quality healthcare when you need it most. Blue Cross Health Insurance offers affordable coverage options that empower you to take control of your health and well-being.

| Feature | Benefits |

|---|---|

| Comprehensive Coverage | Protection against a wide range of health care expenses |

| Affordable Premiums | Plans designed to fit various budgets |

| Nationwide Network | Access to a vast network of healthcare providers |

| Wellness Programs | Support for healthy living and preventive care |

| Exceptional Customer Service | Dedicated team to assist with any insurance needs |

Conclusion

Blue Cross Health Insurance provides affordable coverage options that prioritize your well-being and financial security. Their comprehensive plans and commitment to customer satisfaction make them a trusted choice for individuals and families seeking quality health insurance. By investing in Blue Cross Health Insurance, you empower yourself to take control of your health and well-being, knowing that you have the protection you need to face unexpected medical expenses.

Remember, health insurance is not just a financial investment; it's an investment in your health and peace of mind. Choose Blue Cross Health Insurance today and secure your well-being for the future.