Drew Goins: Unlocking Success Through Real Estate Investment And Business Ownership? If you are here likely looking for a book that will help you in this field. This is the right place for you. Drew Goins: Unlocking Success Through Real Estate Investment And Business Ownership has published today, June 2, 2023.

Editor's Notes: Drew Goins: Unlocking Success Through Real Estate Investment And Business Ownership has published today, June 2, 2023. This book is very important for everyone specially who want to move forward into business specially in Real Estate Investment and Business Ownership. We analyzed and dig every detail of information that the author Drew Goins put it into this book and we made Drew Goins: Unlocking Success Through Real Estate Investment And Business Ownership guide to help you made a right decision.

The new book, Drew Goins: Unlocking Success Through Real Estate Investment And Business Ownership, co-authored by Drew Goins himself, will change the way you think about investing in real estate as an entrepreneur. He shared his proven 6-step system to help you break free from the corporate grind, build passive income, and achieve financial freedom through real estate investing and building successful businesses.

Key Differences

| Drew Goins: Unlocking Success | Other Books | |

|---|---|---|

| Focus | Real estate investing and business ownership | Various financial topics |

| Author's experience | Seasoned real estate investor and entrepreneur | May not have direct experience in real estate investing |

| Content | Step-by-step system for real estate investing and business ownership | General advice and information on finance |

Main Article Topics

- The importance of financial literacy for real estate investors

- How to identify and evaluate real estate investment opportunities

- The different types of real estate investments available

- How to build a successful real estate investment portfolio

- The importance of business ownership for real estate investors

- How to start and grow a successful business

- The benefits of combining real estate investing and business ownership

FAQ

Drew Goins, a renowned expert in real estate investment and business ownership, has compiled a list of frequently asked questions to help you navigate the path to success.

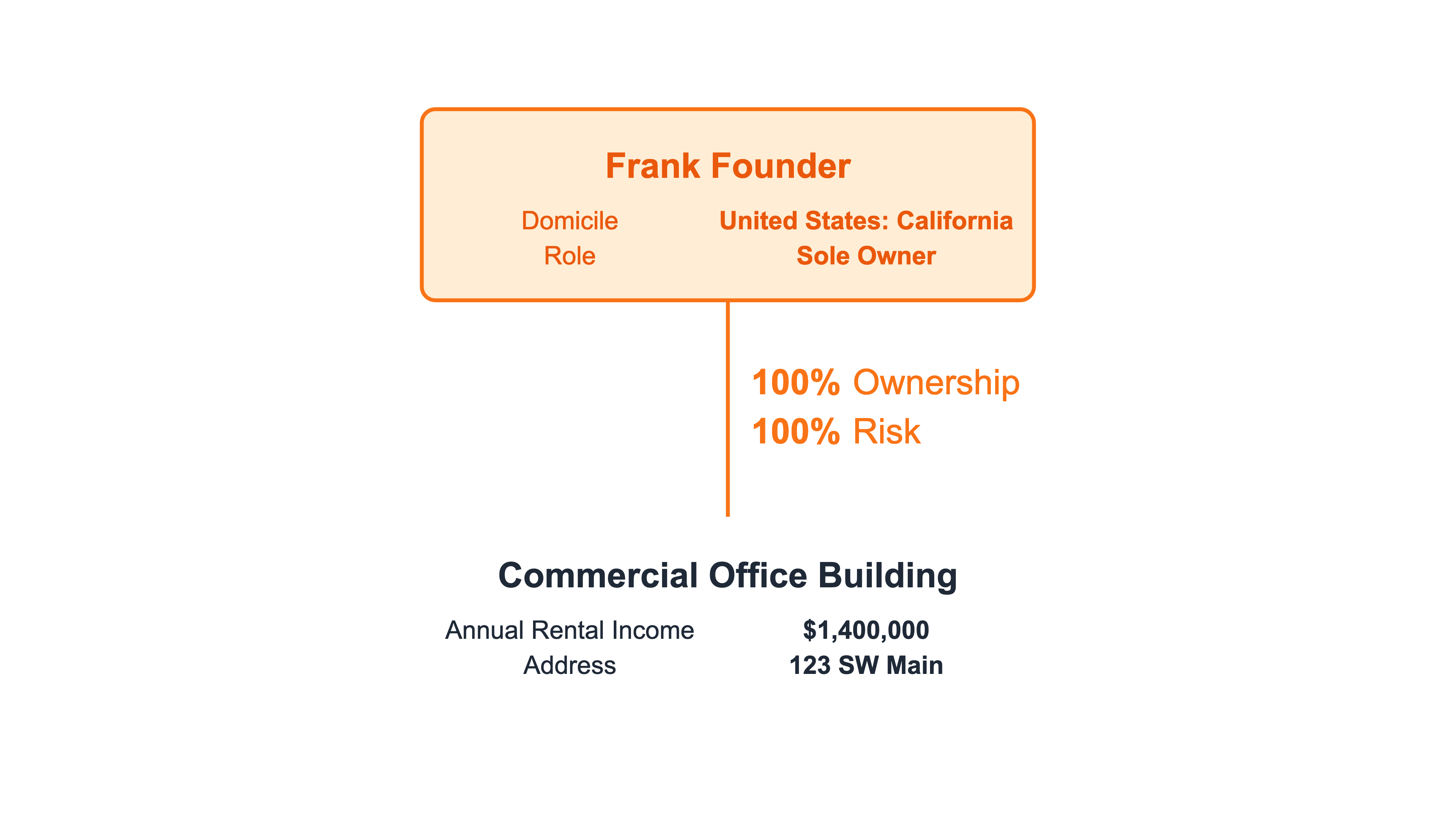

Discover Real Estate Investment LLC Structures - Source lexchart.com

Question 1: How do I get started with real estate investing?

Answer: Research market trends, identify potential properties, secure financing, and build a strong team of professionals.

Question 2: What are the different strategies for investing in real estate?

Answer: Buy-and-hold rentals, fix-and-flips, house hacking, and commercial real estate offer various investment approaches.

Question 3: How do I finance a real estate investment?

Answer: Explore traditional mortgages, private money, hard money loans, or seller financing to secure funding.

Question 4: What are the tax implications of real estate investing?

Answer: Depreciation, capital gains, and rental income deductions can impact your tax obligations. Seek professional advice for specific tax guidance.

Question 5: How do I manage rental properties efficiently?

Answer: Utilize property management software, screen tenants thoroughly, establish clear lease agreements, and conduct regular inspections.

Question 6: What are the benefits of business ownership?

Answer: Enjoy flexibility, control over your work, potential for higher earnings, and the opportunity to pursue your passions.

Navigating the complexities of real estate investment and business ownership requires careful planning and continuous learning. Embrace these insights and empower yourself with the knowledge you need to succeed.

To delve deeper into these topics, continue reading for a comprehensive article that explores each aspect in greater detail.

Tips

Unveiling the secrets to real estate success can lead to a path of financial freedom and substantial returns. One key player in this field is Drew Goins: Unlocking Success Through Real Estate Investment And Business Ownership, who shares valuable insights on navigating the complexities of real estate investment.

Tip 1: Due Diligence - The Cornerstone of Success:

Thorough due diligence is the bedrock of every successful real estate venture. Analyze market conditions, research neighborhoods, and meticulously examine potential properties to make informed decisions. Overlooking this crucial step can lead to costly pitfalls.

Tip 2: Location, Location, Location:

In real estate, location reigns supreme. Invest in areas with strong growth potential, desirable amenities, and high tenant demand. Proximity to employment centers, transportation hubs, and popular attractions can significantly enhance property value and rental income.

Tip 3: Patience and Discipline - Navigating Market Cycles:

Real estate markets are cyclical in nature. Exercise patience and stick to a disciplined investment strategy to weather market downturns. Remember that long-term appreciation outpaces short-term fluctuations. Don't succumb to emotional decision-making based on market hype.

Tip 4: Networking - Unlocking Opportunities:

Building a robust network in the real estate industry provides access to exclusive deals, industry knowledge, and invaluable connections. Attend industry events, join professional organizations, and foster relationships with brokers, lenders, and potential investors.

Tip 5: Seek Mentorship - Learning from the Masters:

Partner with experienced real estate investors or mentors who can guide you through the nuances of the field. Their wisdom and guidance can help you avoid costly mistakes, maximize returns, and accelerate your progress toward financial success.

By embracing these time-tested principles, you can transform your real estate investments into a powerful engine for wealth creation and financial independence.

Drew Goins: Unlocking Success Through Real Estate Investment And Business Ownership

Drew Goins, a prominent figure in the real estate industry and business ownership, has achieved remarkable success by leveraging key aspects that drive his ventures. These include:

- Strategic Investments: Identifying and acquiring properties with high potential for appreciation.

- Value Creation: Enhancing property value through renovations, upgrades, and effective management.

- Market Analysis: Thoroughly researching market trends and demographics to make informed decisions.

- Financial Literacy: Understanding financial principles, leveraging financing options, and managing cash flow effectively.

- Business Acumen: Possessing a deep understanding of business operations, customer service, and marketing strategies.

- Leadership and Vision: Inspiring and motivating teams, setting clear goals, and driving innovation.

These key aspects are interconnected and essential for success in real estate investment and business ownership. Goins's ability to master these elements has enabled him to build a thriving portfolio, create value for investors, and establish successful businesses. His achievements serve as a testament to the importance of these fundamental principles.

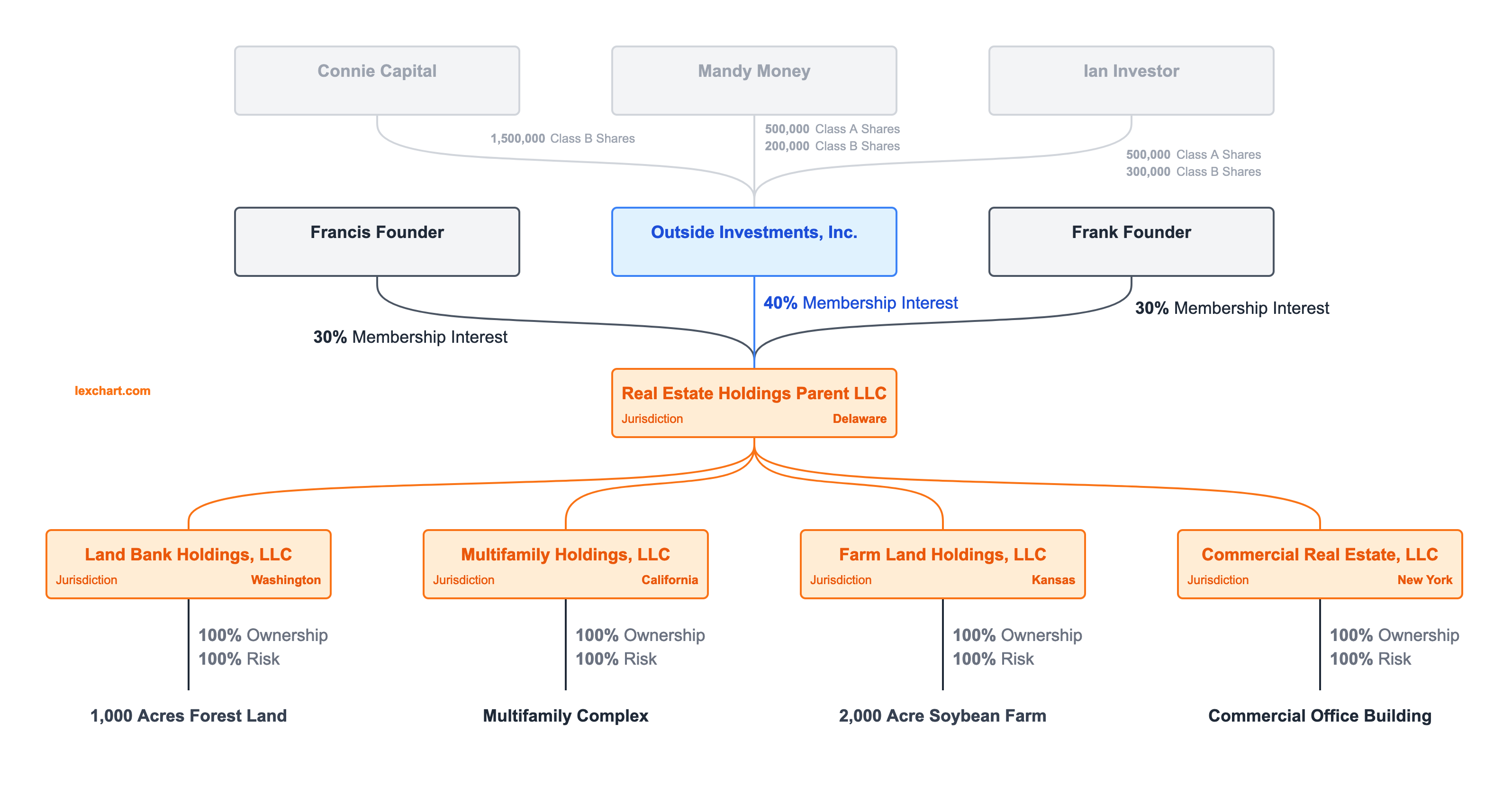

Discover Real Estate Investment LLC Structures - Source lexchart.com

Drew Goins: Unlocking Success Through Real Estate Investment And Business Ownership

Drew Goins exemplifies the power of real estate investment and business ownership as pathways to success. His entrepreneurial journey underscores the transformative impact of strategic investments in real estate and the synergy between real estate and business ventures. By leveraging his real estate expertise, Goins has created multiple revenue streams, expanded his business portfolio, and fostered a thriving business ecosystem within his community. His success story serves as a testament to the interconnectedness of these two domains and the potential they hold for unlocking financial freedom and entrepreneurial fulfillment.

Real Estate Investment Advantages and Disadvantages - Hauzisha - Source www.hauzisha.co.ke

Goins' real estate investments have provided a solid foundation for his business endeavors. The rental income generated from his properties has not only supplemented his income but also provided capital for business expansion. He has utilized his real estate holdings to establish a network of complementary businesses, including a construction company for property maintenance and renovations, a property management firm to oversee his growing rental portfolio, and a real estate brokerage to facilitate transactions and capitalize on market opportunities. This integrated approach has allowed Goins to maximize the value of his real estate assets while diversifying his income streams and mitigating risk.

The practical significance of understanding this connection lies in recognizing the potential for wealth creation and business growth that arises from the intersection of real estate and business ownership. Real estate investments can provide financial stability, passive income, and tax benefits that can fuel entrepreneurial pursuits. Conversely, business ventures can generate additional income, expand professional networks, and offer opportunities for innovation. By embracing this interconnectedness, individuals can unlock a world of possibilities and create a strong foundation for long-term success.

| Real Estate Investment | Business Ownership |

|---|---|

| Provides financial stability and passive income | Generates additional income streams |

| Offers tax benefits | Expands professional networks |

| Serves as a capital source for business expansion | Provides opportunities for innovation |

| Can mitigate financial risk | Can enhance real estate investment returns |