Federal Reserve Minutes Reveal Economic Outlook And Policy Considerations: The U.S. Federal Reserve has published the minutes of its latest policy meeting, providing insights into the central bank's economic outlook and policy considerations.

ASEAN+3 Fiscal Developments, Outlook, and Policy Considerations - AMRO ASIA - Source www.amro-asia.org

Editor's Notes: "Federal Reserve Minutes Reveal Economic Outlook And Policy Considerations" has published today date. This topic important to read because the Federal Reserve is responsible for setting interest rates and implementing monetary policy in the United States. Its decisions have a significant impact on the economy and financial markets. The minutes of the Federal Reserve's policy meetings provide a detailed account of the discussions and decisions made by the central bank's policymakers.

To help target audience make the right decision, our team has taken the time to analyze the minutes and extract the most important information.

Key Differences or Key takeaways:

| Key Difference | Explanation |

|---|---|

| Economic Outlook | The Federal Reserve is cautiously optimistic about the economic outlook. The central bank expects economic growth to continue at a moderate pace in the coming months. However, the Fed is also concerned about the risks to the economy, including the ongoing COVID-19 pandemic and the war in Ukraine. |

| Policy Considerations | The Federal Reserve is considering raising interest rates in the coming months to combat inflation. The central bank is also discussing other policy measures, such as reducing the size of its balance sheet. |

FAQ

This FAQ section provides answers to commonly asked questions regarding the latest Federal Reserve minutes, which shed light on the current economic outlook and potential policy considerations.

Question 1: What key economic indicators were discussed in the minutes?

The minutes highlighted concerns regarding elevated inflation, a tight labor market, and slowing economic growth. The Federal Reserve acknowledged the impact of these factors on consumer spending and business investment.

DCP3 Economic Development Board Minutes Reveal Discussions About - Source dillonnews.org

Question 2: What policy measures were considered by the Federal Reserve?

The minutes indicate that the Federal Reserve is considering further interest rate increases to combat inflation. However, the pace and magnitude of these increases will depend on economic data and the evolving inflation outlook.

Question 3: How will the Federal Reserve's actions affect the housing market?

Higher interest rates may lead to an increase in mortgage rates, potentially slowing down the housing market. The Federal Reserve is monitoring the impact of its policies on the housing market and will adjust its approach as needed.

Question 4: What are the potential risks associated with the Federal Reserve's actions?

The Federal Reserve acknowledges that raising interest rates too quickly or too aggressively could lead to an economic slowdown or even a recession. However, the Fed believes that addressing inflation is necessary for long-term economic stability.

Question 5: What is the timeline for the Federal Reserve's policy decisions?

The Federal Reserve typically meets every six to eight weeks to assess economic data and make policy decisions. The next meeting is scheduled for [insert date].

Question 6: How can individuals and businesses prepare for potential changes in interest rates?

Individuals and businesses should consider the impact of higher interest rates on their financial plans, such as mortgages, loans, and investments. Adjusting budgets and exploring alternative financing options may be necessary.

In conclusion, the Federal Reserve's recent minutes provide valuable insights into the current economic outlook and potential policy considerations. By understanding these factors, individuals and businesses can make informed decisions and prepare for potential changes in the economic landscape.

Stay tuned for updates as the Federal Reserve continues to monitor economic data and make policy decisions.

Tips on Understanding the Economic Outlook

To understand the economic outlook, it's crucial to study Federal Reserve Minutes Reveal Economic Outlook And Policy Considerations, which provide valuable insights into the Fed's perspectives on the economy.

Tip 1: Pay attention to the Fed's assessment of the current economic conditions. This includes their views on inflation, employment, and economic growth. Consider how these align with your own observations and expectations.

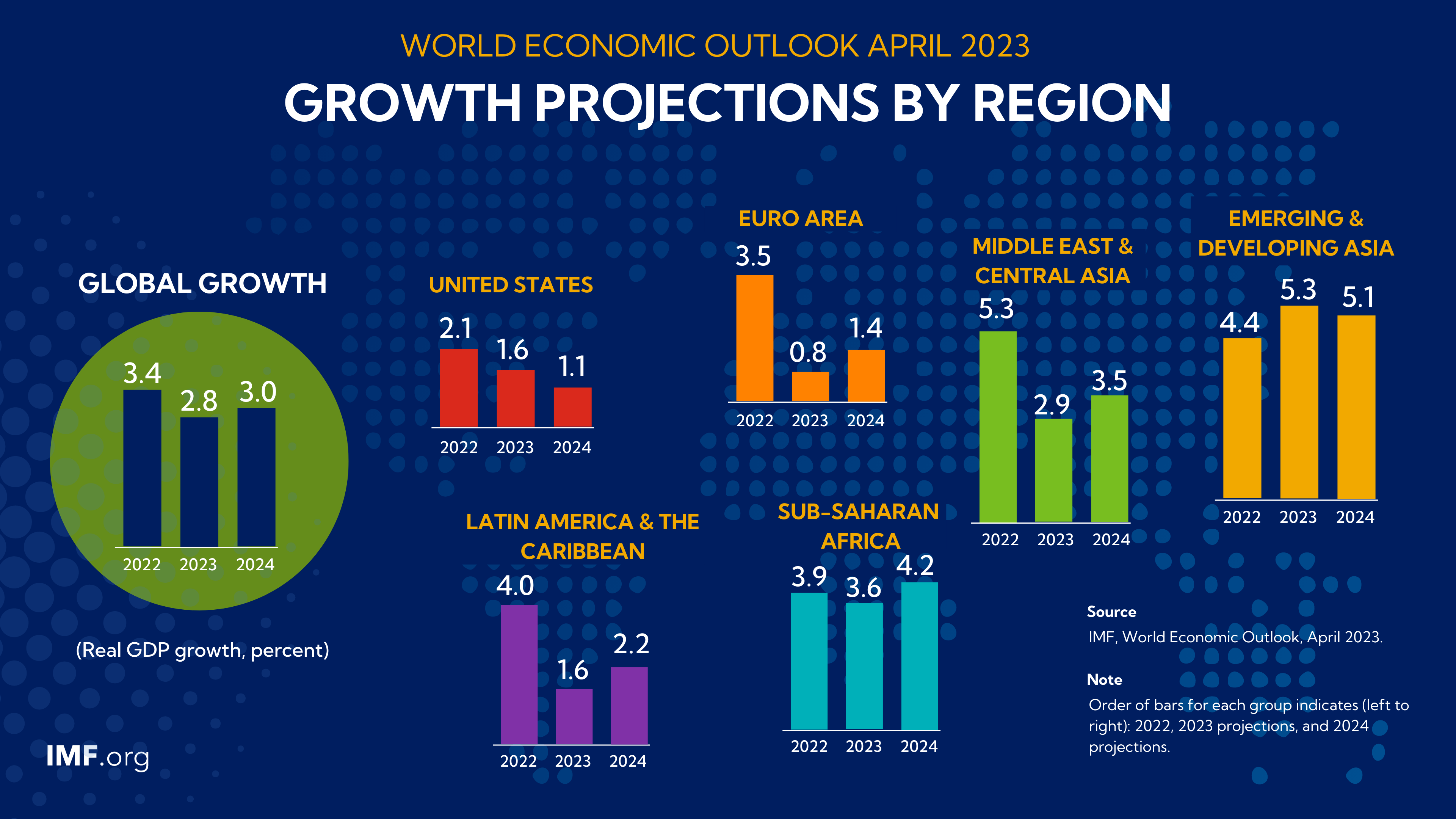

Tip 2: Analyze the Fed's projections for the economy. These projections provide a roadmap of the Fed's expectations for key economic indicators in the coming months or years. Compare them to your own forecasts to identify potential areas of divergence.

Tip 3: Understand the Fed's policy stance. The minutes reveal whether the Fed is maintaining the current policy or considering adjustments to interest rates or other monetary tools. This information is crucial for businesses, investors, and policymakers.

Tip 4: Evaluate the Fed's concerns and risks. The minutes often highlight potential risks to the economic outlook, such as geopolitical tensions or supply chain disruptions. Identify these risks and consider how they could impact your own plans and decisions.

Tip 5: Recognize that the minutes are not always conclusive. The Fed's views and projections can shift over time as new data or events emerge. Stay informed and monitor subsequent minutes and statements to track any changes in the Fed's outlook.

By following these tips, you can gain a deeper understanding of the economic outlook and the Fed's policy considerations. This knowledge can help you make informed decisions and navigate the complexities of the modern economy.

Federal Reserve Minutes Reveal Economic Outlook And Policy Considerations

The Federal Reserve's recent meeting minutes provide valuable insights into the central bank's assessment of the economic outlook and its policy considerations. Key aspects discussed include:

- Economic Growth: The Fed noted a continued recovery in the economy, albeit at a slower pace than earlier anticipated.

- Inflation: Concerns about persistently high inflation remained, with the Fed emphasizing its commitment to price stability.

- Monetary Policy: The Fed signaled its intention to continue raising interest rates gradually to combat inflation.

- Labor Market: The strength of the labor market was recognized, but concerns were raised about potential wage pressures adding to inflation.

- Financial Stability: The Fed expressed vigilance in monitoring financial stability risks, particularly in the context of rising interest rates.

- Forward Guidance: The Fed emphasized the data-dependent nature of its policy decisions, indicating a willingness to adjust its stance as the economic situation evolves.

These aspects collectively highlight the Federal Reserve's cautious optimism about the economic outlook and its commitment to maintaining price stability while fostering sustainable growth. The minutes underscore the importance of the Fed's ongoing efforts to balance these objectives and its readiness to adapt its policy stance as necessary.

Economic Outlook 2025 India - Jack Lewis - Source jacklewis.pages.dev

Federal Reserve Minutes Reveal Economic Outlook And Policy Considerations

The Federal Reserve's minutes from its most recent meeting provide insight into the central bank's economic outlook and policy considerations. The minutes reveal that the Fed is concerned about the impact of the COVID-19 pandemic on the economy and is considering additional policy measures to support the recovery. The minutes also show that the Fed is monitoring inflation closely and is prepared to take action if it becomes a threat to the economy. The minutes are an important source of information for investors, economists, and policymakers, as they provide insight into the Fed's thinking and its plans for the future.

Federal Reserve Minutes Reveal Angst Regarding ‘Upside Inflation Risks’ - Source www.fxempire.com

The Fed's economic outlook is generally positive, but the central bank is concerned about the impact of the COVID-19 pandemic on the economy. The pandemic has caused a sharp decline in economic activity, and the Fed is worried that the recovery could be slow and uneven. The Fed is also concerned about the impact of the pandemic on inflation. The pandemic has caused a sharp increase in the money supply, and the Fed is worried that this could lead to inflation down the road.

The Fed is considering additional policy measures to support the recovery. The minutes show that the Fed is considering cutting interest rates further and increasing its purchases of Treasury bonds and mortgage-backed securities. These measures would help to lower interest rates and make it easier for businesses and consumers to borrow money. The Fed is also considering providing additional support to state and local governments, which have been hit hard by the pandemic.

The Fed is monitoring inflation closely and is prepared to take action if it becomes a threat to the economy. The minutes show that the Fed is concerned about the potential for inflation to rise down the road. The Fed is prepared to raise interest rates if it believes that inflation is becoming a problem. The Fed is also prepared to sell Treasury bonds and mortgage-backed securities if it believes that this would help to reduce inflation.

The minutes from the Fed's most recent meeting are an important source of information for investors, economists, and policymakers. The minutes provide insight into the Fed's thinking and its plans for the future. The minutes show that the Fed is concerned about the impact of the COVID-19 pandemic on the economy and is considering additional policy measures to support the recovery. The minutes also show that the Fed is monitoring inflation closely and is prepared to take action if it becomes a threat to the economy.

| Key Insights | Practical Significance |

|---|---|

| The Fed is concerned about the impact of the COVID-19 pandemic on the economy. | This could lead to the Fed taking additional policy measures to support the recovery. |

| The Fed is monitoring inflation closely. | This could lead to the Fed raising interest rates if it believes that inflation is becoming a problem. |

| The minutes from the Fed's most recent meeting are an important source of information for investors, economists, and policymakers. | The minutes provide insight into the Fed's thinking and its plans for the future. |