Maximize Your Financial Returns: Interest Rates And Banking Guide

Editor's Notes: Due to the Its direct impact on financial planning and investment decisions, understanding interest rates and banking is crucial.

We have compiled this comprehensive guide after conducting thorough research and analysis to empower you with the knowledge you need to make informed financial decisions.

Key Takeaways:

| Interest Rates | Banking |

|---|---|

| Impact on borrowing and saving costs | Services provided by financial institutions |

| Set by central banks | Deposit accounts, loans, and other products |

| Influence on economic growth and inflation | Impact on financial stability and consumer spending |

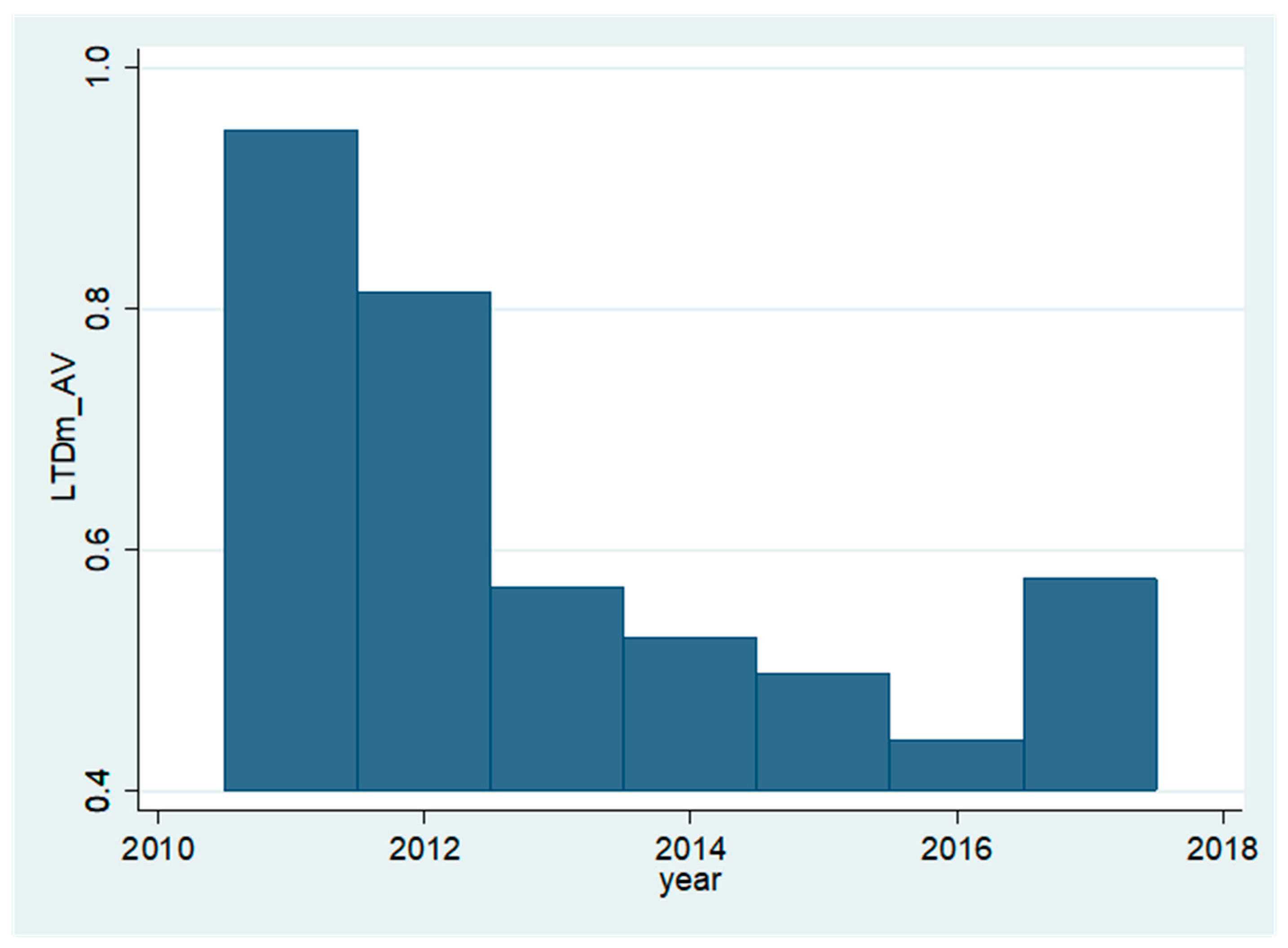

2.1 interest rates banking institutions 2018 - Emily Mills - Source kikiemilymills.blogspot.com

Main Article Topics:

FAQ

This comprehensive FAQ section provides answers to frequently asked questions and clarifies common misconceptions regarding interest rates and banking. Expand your understanding and optimize your financial returns.

Premium Photo | Maximizing financial potential logo design for a - Source www.freepik.com

Question 1: What is the relationship between interest rates and inflation?

Answer: Interest rates and inflation are inversely related. As inflation rises, the value of money declines, leading central banks to increase interest rates to curb inflation and stabilize prices.

Question 2: How do interest rates affect borrowing and savings?

Answer: Higher interest rates make borrowing more expensive, reducing the demand for loans and stimulating savings. Conversely, lower interest rates encourage borrowing and discourage savings.

Question 3: What are the different types of interest rates?

Answer: Interest rates vary based on factors such as the term, risk, and type of financial instrument. Common types include prime rate, LIBOR, and bond yields.

Question 4: How can I maximize my returns on savings?

Answer: To maximize returns, consider factors such as interest rates, fees, and account features. Explore different savings accounts, certificates of deposit, and money market accounts.

Question 5: What is the role of banks in the interest rate market?

Answer: Banks play a crucial role as intermediaries, facilitating borrowing and lending. They set interest rates on loans and deposits, influenced by market conditions and central bank policies.

Question 6: How can I stay informed about interest rate changes?

Answer: Monitor economic news, follow central bank announcements, and consult financial advisors. Up-to-date information allows for informed financial decisions.

By addressing these fundamental questions, this FAQ empowers you with the knowledge to navigate the complexities of interest rates and banking. Stay informed, make informed decisions, and optimize your financial outcomes.

Proceed to the next article section for further insights and actionable advice.

Tips

The complexity of interest rates and banking can be daunting,Interest Rates And Banking: A Comprehensive Guide To Understanding And Maximizing Your Financial Returns decoding this landscape can unlock significant financial advantages.

Tip 1: Grasp the Mechanics of Interest Rates

Comprehending the concept of interest rates, how they fluctuate, and the impact on various financial instruments is paramount. This knowledge equips you to make informed decisions regarding savings, investments, and debt management.

Tip 2: Explore Different Types of Bank Accounts

Familiarize yourself with the diverse types of bank accounts available, each tailored to specific needs. Understanding the features, fees, and interest rates associated with each account empowers you to select the most suitable option for your financial goals.

Tip 3: Leverage Interest-Bearing Accounts

Maximize your savings potential by utilizing interest-bearing accounts, such as savings accounts or certificates of deposit (CDs). These accounts allow your funds to accumulate interest over time, providing a passive stream of income.

Tip 4: Negotiate Favorable Interest Rates

When borrowing money, don't hesitate to negotiate the best possible interest rate. Factors such as your creditworthiness, loan amount, and repayment period can influence the rate you receive.

Tip 5: Monitor Interest Rate Changes

Stay informed about interest rate fluctuations and their potential impact on your finances. By anticipating changes, you can adjust your financial strategies proactively to mitigate risks and seize opportunities.

These tips provide a starting point for navigating the complexities of interest rates and banking. By implementing these strategies, you can optimize your financial returns and achieve your financial objectives.

Interest Rates And Banking: A Comprehensive Guide To Understanding And Maximizing Your Financial Returns

Interest rates play a pivotal role in banking and finance, influencing various aspects such as lending, saving, and investment decisions. To maximize financial returns, it's crucial to comprehend the factors that drive interest rate fluctuations and how they impact banking practices.

- Central Bank Policies: Central banks adjust interest rates to control inflation, economic growth, and currency stability.

- Economic Conditions: Supply and demand dynamics, inflation levels, and economic growth prospects affect interest rate movements.

- Risk Premium: Lenders charge a risk premium based on borrower creditworthiness, influencing interest rates offered on loans.

- Term Structure: Interest rates vary based on loan or investment maturity, often displaying an upward-sloping yield curve.

- Inflation Expectations: Market participants adjust interest rate expectations based on future inflation projections.

- Global Market Forces: International economic conditions, currency fluctuations, and geopolitical events can affect interest rate levels.

Maximizing Returns: A Comprehensive Guide to Rental Property - Source newcityfinancial.com

Understanding these key aspects empowers individuals and institutions to make informed decisions about borrowing, lending, and investment strategies. For instance, rising interest rates make borrowing more expensive, but they also lead to higher returns on savings. Conversely, falling interest rates encourage borrowing but result in lower interest earned on deposits. By staying abreast of interest rate trends and their implications, individuals can optimize their financial returns and navigate the complexities of banking.

Interest Rates And Banking: A Comprehensive Guide To Understanding And Maximizing Your Financial Returns

Interest rates and banking have a profound connection that impacts the global economy and personal finances. Interest rates are the cost of borrowing money, set by central banks to influence economic activity. Banks are financial institutions that accept deposits from individuals and businesses and use those funds to make loans.

Premium Photo | Maximizing financial potential logo design for a - Source www.freepik.com

When interest rates increase, the cost of borrowing rises, making it more expensive for businesses to invest and consumers to purchase homes and cars. This can slow economic growth and reduce inflation. Conversely, when interest rates decrease, borrowing becomes cheaper, stimulating economic activity and potentially leading to inflation.

Understanding the relationship between interest rates and banking is crucial for making informed financial decisions. By monitoring interest rate trends and forecasts, individuals and businesses can plan their borrowing and saving strategies to maximize their financial returns. For example, when interest rates are low, it may be advantageous to take out a mortgage or invest in interest-bearing accounts. Conversely, when interest rates are high, it may be prudent to pay down debt or seek fixed-rate savings products.

In conclusion, interest rates and banking are inextricably linked, and their interplay has a significant impact on the economy and personal finances. Understanding the dynamics of this relationship is paramount for making sound financial choices and achieving long-term financial success.