IRS Stimulus Checks: Eligibility Criteria And How To Get Yours

Editor's Notes: IRS Stimulus Checks: Eligibility Criteria And How To Get Yours

This topic is important to read because the IRS has issued several rounds of stimulus checks to help Americans cope with the economic impact of the COVID-19 pandemic.

If you are wondering if you are eligible for a stimulus check and how to get yours, this guide will provide you with the information you need.

We have analyzed the latest information from the IRS and other sources to put together this comprehensive guide to IRS Stimulus Checks: Eligibility Criteria And How To Get Yours.

We hope that this guide will help you determine if you are eligible for a stimulus check and how to get yours.

Stimulus Payment News - Latest Stimulus Check updates and news - Source www.marca.com

FAQs on IRS Stimulus Checks: Eligibility and Acquisition

The Internal Revenue Service (IRS) has outlined specific requirements to determine eligibility for and outline the process of obtaining stimulus payments. This FAQ aims to provide clear information on these matters.

Stimulus Checks Update 2024 Irs - Cammi Norrie - Source saschawblithe.pages.dev

Question 1: Who is eligible for a stimulus check?

Individuals with an annual gross income below $75,000 for single filers and $150,000 for married couples filing jointly are generally eligible for a full stimulus payment. The amount of payment decreases for those with higher incomes.

Question 2: How do I get my stimulus check?

The IRS will automatically send the stimulus payment to eligible individuals based on the information in their tax returns or Social Security records. No additional action is typically required.

Question 3: When can I expect to receive my stimulus check?

The distribution of stimulus checks began in early 2023. The exact timing of receipt depends on several factors, including the individual's filing status and preferred payment method.

Question 4: What if I am not eligible for a stimulus check?

Individuals who do not meet the income eligibility criteria may still be able to claim a stimulus payment as part of their 2022 tax return through a process called the "Recovery Rebate Credit."

Question 5: How can I track the status of my stimulus check?

The IRS provides an online tool called the "Get My Payment" portal that allows individuals to track the status of their stimulus payment and estimated delivery date.

Question 6: Is it possible to change my payment information?

If an individual's payment information has changed since filing their tax return, they can contact the IRS to update it. The IRS will make every effort to accommodate changes and deliver the stimulus payment accordingly.

Remember, this is a general overview of frequently asked questions. For specific and up-to-date information, it is recommended to consult the official IRS website or seek professional guidance.

Continue reading for more insights on managing your finances during this economic climate.

Tips for IRS Stimulus Checks

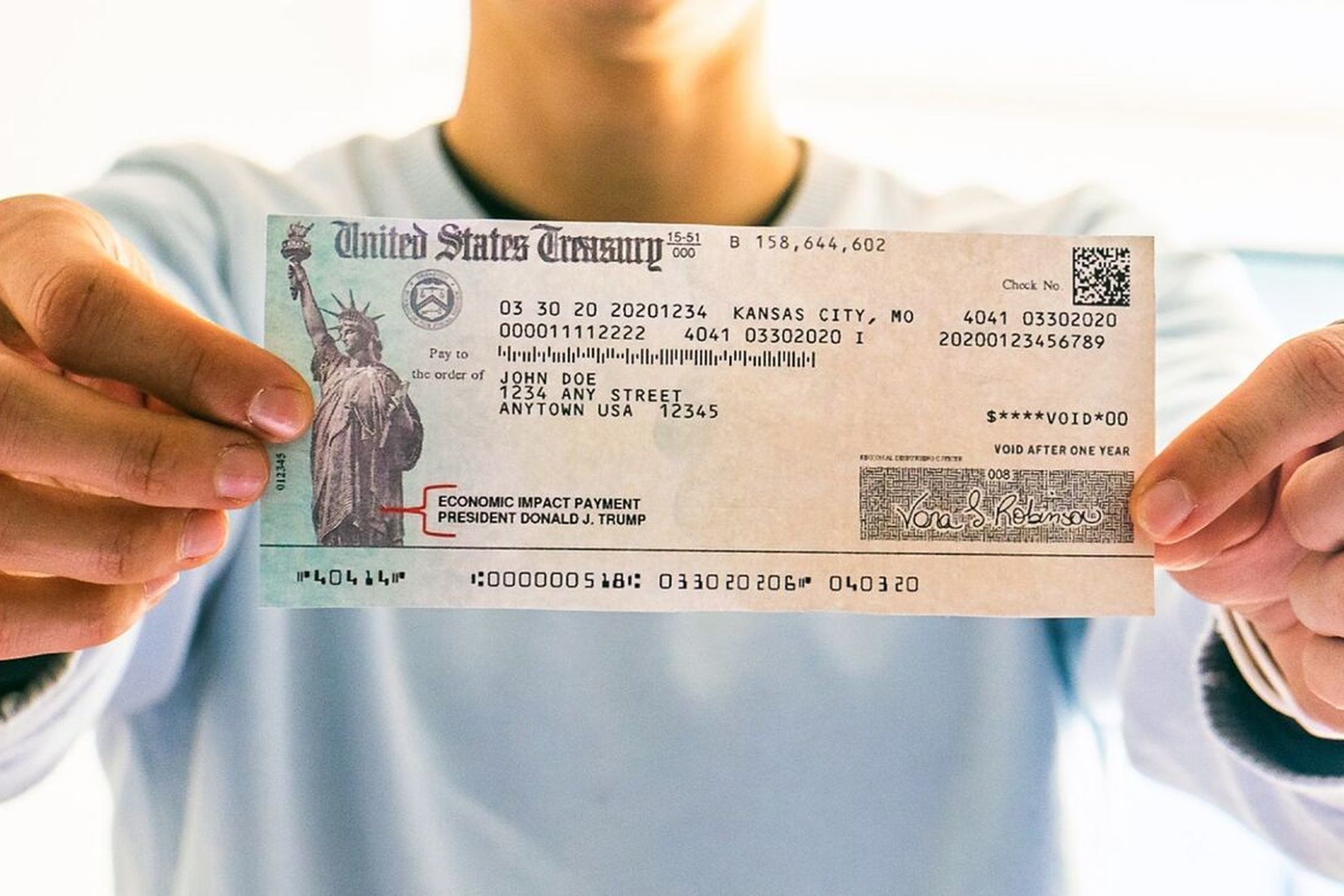

The Internal Revenue Service (IRS) has issued several rounds of stimulus checks to help Americans cope with the financial impact of the COVID-19 pandemic. To ensure you receive your payment, it's crucial to understand the eligibility criteria and follow the necessary steps.

Tip 1: Check Eligibility

To be eligible for a stimulus check, you must meet certain income, residency, and citizenship requirements. Visit the IRS Stimulus Checks: Eligibility Criteria And How To Get Yours page for detailed information on these criteria.

Tip 2: Track Payment Status

Once you have determined your eligibility, you can track the status of your payment using the "Get My Payment" tool on the IRS website. This tool will provide an estimated delivery date or inform you if your payment has already been issued.

Tip 3: Direct Deposit or Mail

Stimulus checks are typically issued via direct deposit if you have provided the IRS with your bank account information. If not, you will receive a paper check in the mail. Monitor your bank account or mailbox for the payment.

Tip 4: Verify Payment Amount

Ensure that the amount you receive matches the estimated amount you are eligible for based on the IRS guidelines. If there is a discrepancy, contact the IRS for clarification.

Tip 5: Use Stimulus Funds Wisely

Use the stimulus money responsibly to address immediate financial needs, such as paying bills, groceries, or medical expenses. Consider saving some funds for future emergencies as well.

Summary: Understanding the eligibility requirements, tracking payment status, and using the funds wisely are essential for maximizing the benefits of the IRS stimulus checks. Remember to visit the IRS website or contact them for any further assistance.

IRS Stimulus Checks: Eligibility Criteria And How To Get Yours

Understanding the IRS stimulus check eligibility criteria and application process is crucial for individuals seeking financial assistance during the COVID-19 pandemic. Six key aspects to consider include income limits, residency status, tax filing requirements, direct deposit options, paper check distribution, and the Economic Impact Payment Tool.

IRS Tax Fourth Stimulus Checks 2024 Update: A Good Guide! - Source ideasplusbusiness.com

- Income Thresholds: Eligibility is based on adjusted gross income (AGI) limits.

- U.S. Residency: Citizens, residents, and resident aliens are eligible.

- Tax Filing: Individuals must have filed 2018 or 2019 tax returns.

- Direct Deposit: Payments are deposited directly into bank accounts.

- Paper Checks: Checks are mailed to those without direct deposit information.

- Economic Impact Payment Tool: The IRS tool provides status updates and allows individuals to enter bank information.

These aspects provide a comprehensive understanding of the eligibility criteria and application process for IRS stimulus checks. Individuals should carefully review the requirements and utilize the Economic Impact Payment Tool to ensure timely receipt of their payments.

Federal Stimulus Checks - the Eligibility Criteria and Requirements - Source 1040abroad.com

IRS Stimulus Checks: Eligibility Criteria And How To Get Yours

The connection between "IRS Stimulus Checks: Eligibility Criteria And How To Get Yours" lies in the importance of understanding the requirements and procedures involved in receiving government financial assistance. Stimulus checks are a crucial component of economic recovery efforts, providing financial relief to individuals and families during times of economic hardship.

Stimulus Checks In 2023: Claim Yours Now! | Digital Market News - Source www.digitalmarketnews.com

The eligibility criteria for stimulus checks are designed to target those most in need, such as low-income earners, unemployed individuals, and families with children. Understanding the eligibility requirements is essential to ensure that those eligible receive the financial assistance they are entitled to.

The process of obtaining a stimulus check involves meeting the eligibility criteria, providing necessary documentation, and following the prescribed application procedures. By understanding these steps, individuals can proactively take action to receive their stimulus checks and benefit from the financial support provided by the government.

Conclusion

In conclusion, understanding the eligibility criteria and application process for IRS Stimulus Checks is crucial for accessing government financial assistance during times of economic hardship. By meeting the eligibility requirements and following the necessary steps, individuals and families can receive much-needed financial relief to navigate challenging economic circumstances.

The importance of stimulus checks in economic recovery efforts cannot be overstated, as they provide a direct infusion of funds into the economy, stimulating consumer spending and supporting businesses. By ensuring that stimulus checks reach those most in need, the government plays a vital role in mitigating the impact of economic downturns and fostering economic growth.